Having a private vehicle helps you cut down on waiting times for public transport. What otherwise required you to plan your commute according to the public transport system, now gives you the freedom to begin your commute as per convenience. Among private modes of transport, a two-wheeler is generally preferred in an urban as well as rural setting; both for different reasons.

In cities, the rising congestion makes it easy to manoeuvre through traffic snarls and save time whereas the in the rural areas, it is preferred for its affordability. But all is not done once you have bought a two-wheeler. Next steps include getting it registered and buying a suitable 2 wheeler insurance policy. It is mandatory by the law to avail at least third-party insurance cover for your vehicle.

Let’s us look at what is a third-party insurance policy –

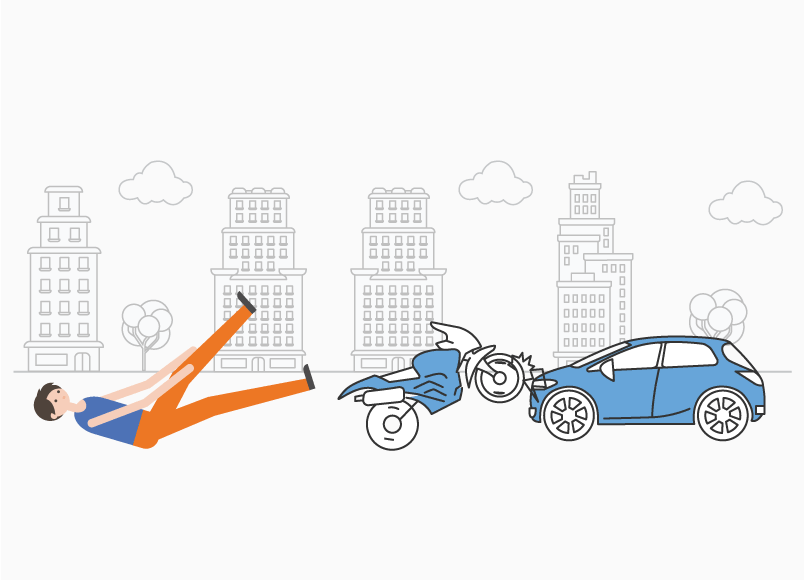

A third-party policy is mandatory by the government. The Motor Vehicles Act of 1988 lays down the provisions for all vehicles registered in the country to have a third-party insurance cover. Moreover, riding your bike without one can attract hefty penalty and your sure don’t want to be penalised for it. When you buy two wheeler insurance third party plan, you receive coverage against the liability incurred on another person, property or vehicle. For instance, if you injure a person during an accident, the sum that may be due to such other person is paid by your insurance company.

What are the features of a third-party bike insurance?

Here are some features that that emphasise the importance of third-party plans-

- Limited documentation: Buying a third-party two-wheeler insurance cover is straightforward with limited needs for documentation. You no longer require to furnish multiple details about your bike and its past claim history when buying a third-party two-wheeler insurance.

- Coverage for death as well as injuries: A third-party policy provides coverage for injuries as well as death. In the event of an accident where the insured’s vehicle is involved, the insurance company pays for the cost of hospitalisation too. Further, if there is loss of income to such third-person due to disability, it is also covered by this policy.

- Include third-party property damage: Third-party property damages are covered up to an amount of ₹7,50,000 whereas there is no such monetary limit for death and injuries.

- Compensation to dependants: An accident causing the death of such third-party also includes the cost of compensation payable to the family of such other person.

- Affordability: Since it a mandatory coverage, the premiums are decided by the regulator, the IRDAI (The Insurance Regulatory and Development Authority of India). These premiums are determined keeping in mind the entire demographic of the nation and thus are at an affordable level. Affordability makes it accessible to all and this two wheeler insurance renewalis seamless.

The above benefits make it a must-have insurance coverage both legally and from a safety standpoint. However, when you are shortlisting your coverage alternatives, remember that a third-party policy doesn’t include protection for damages to your bike. These amounts shall be required to be paid from your own account. So, keep in mind these benefits and make a smart choice of insurance cover for your dream bike. Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure/policy wording carefully before concluding a sale. Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure/policy wording carefully before concluding a sale.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply