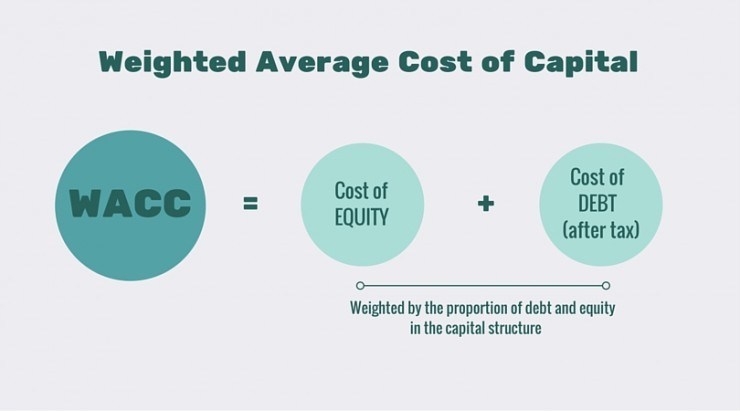

The weighted average cost of capital or WACC is a financial ratio which helps the company in calculating the cost of their financing and assets acquired and compare the debt and business equity structure. The ratio also helps in finding out the weight of debt. Well, management basically uses WACC for taking a decision regarding the company and whether they should use their debt or their equity to finance the purchases.

Weighted Average Cost of Capital:

Well, WACC has known for its comprehensive as it averages all capital sources such as common stock, long term debt, bonds, and preferred stock in order to measure the borrowing funds’ average cost. It is also complex. However, understanding the cost of debt can be simple. Whereas stated interest rate issues with the Bonds and long-termed debts to get the cost overall. Well, that’s why the investors do not focus on measuring them as they all capital price indicator.

Analysing WACC:

WACC can be considered as risk management. As the cost of average increases, the company should also increase their earning as well as paying ability. The investors use this WACC to get the acceptable rate of return on its minimum.

Formula:

For calculating the WACC, there is a formula which can be used for getting the answers. here is what the formula looks like

WACC= E/V X RE + D/V X Rd X (1-Tc)

Well the elements which are used in the formula, here is the list and what does that they mean

Re = Total cost of equity

E= market value of total equity

Rd= total cost of debt

D= market value of total debt

V= combining debt and equity of the company and its total market value or E+D

E/V= equity portion of total financing

D/V= debt portion of total financing

Tc= Income tax rate

Why is This Ratio Used?

The company gets the idea of whether they should invest in financing the new asset purchase with their debt or equity. With this ratio, they compare both and evaluate the reasons. Also choosing the option between debt and equity can affect the company, especially when it comes to profitability and its stock price overall.

Management uses this ratio to balance out the stock price, total cost of purchasing the asset, and expectation investor return. Also, the board directors and executives of the business use this ratio to find out if a merger is good or not.

On another hand. Investors use this ratio to find out if the company is good enough for loaning or not. Well, WACC shows the average cost of borrowing money, including all financial structures. If the WACC is higher, that shows the company has financial structure beneficial, and they are going to less free cash when it comes to paying off their debt or shareholder.

If the average increases, it shows that the company is going to create value less. With this, the investors get the idea if they should invest or find something else.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply