The future of credit card processing is touchless. Whether your customers are already shopping with contactless pay and mobile pay options or not, find out how you can stay at the forefront of payment technology by offering these options. Learn more about these exciting features and see how you can start offering them at your business or join the growing credit card processing careers by offering these services to local businesses.

Intuitive Design

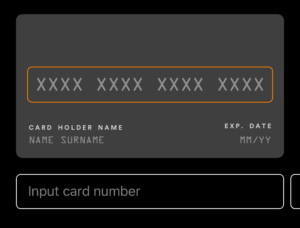

Credit card processing needs to be convenient and streamlined. Choose a modern POS system to allow for easy payments wherever your customers are. At restaurants, mobile POS systems allow customers to pay for their tab right at their table. Clothing stores can ring up customers right at the racks to avoid long lines at the front of the store.

Credit card processing needs to be convenient and streamlined. Choose a modern POS system to allow for easy payments wherever your customers are. At restaurants, mobile POS systems allow customers to pay for their tab right at their table. Clothing stores can ring up customers right at the racks to avoid long lines at the front of the store.

Customer-facing printer displays reduce the risk of miscommunication during the sale process. Let your customers know exactly how much they are going to pay before they insert their EMV chip card or pull out their mobile device for mobile pay. If there’s an issue with the price, your customers can clearly see the amount before the transaction is processed.

A large screen for the cashier makes it easy to quickly ring up customers. Whether you have a scanning device or quickly navigate a menu of products, modern POS systems have customizable displays that make it easy to train your staff on a new system and decrease wait times for customers checking out.

Secure Processing

Identity theft and credit card information theft are real concerns. Give your customers peace of mind when they shop at your location by using the latest security features. EMV chip reading, fingerprint scanning and encryption features keep personal data protected. The Clover Station 2.0 is a great example of modern security and convenience wrapped in one.

Identity theft and credit card information theft are real concerns. Give your customers peace of mind when they shop at your location by using the latest security features. EMV chip reading, fingerprint scanning and encryption features keep personal data protected. The Clover Station 2.0 is a great example of modern security and convenience wrapped in one.

Dynamic Management Tools

A POS system now offers far more than simple credit card processing. Manage your entire business through the same intuitive software with included inventory and timesheet management.

A POS system now offers far more than simple credit card processing. Manage your entire business through the same intuitive software with included inventory and timesheet management.

Give your employees an easy system to clock in and clock out. Once you’re ready for payroll, lookup all the essential data for your entire business through this streamlined system. This saves you time when entering payroll information and prevents errors related to paychecks.

Excellent Rewards

Encourage a loyal following at your business with rewards, incentives and more. Clover Rewards allows you to tailor your rewards program to match your target audience and your business model. Offer discounts, daily promotions or free items with frequent shopping.

Encourage a loyal following at your business with rewards, incentives and more. Clover Rewards allows you to tailor your rewards program to match your target audience and your business model. Offer discounts, daily promotions or free items with frequent shopping.

A great rewards program allows you to connect with your customers through emails. Don’t overload your rewards members with emails, but craft monthly reminders of sales, promotions and other reasons to continue to visit your store.

Update Your Credit Card Processing Today

Explore more reasons to upgrade to the latest Clover Flex for sale at your business location. Whether you’re operating a busy retail shop or an intimate dining area, enjoy the convenience, safety and touchless features of the latest credit card processing devices today. Don’t let an outdated POS system discourage customers and employees from connecting with your brand.

Leave a Reply