Return on asset, which is also known as ROA, is counted as one of the types in return on investment or ROI. Well, It’s a metric which is used for measuring the company’s profitability on its business related to their total assets. With the help of ratio, it indicates the performance of the company by making the comparison of the profit or net income. That means the Highers numbers in ratio, the higher the production and management efficiency by the company as well as utilizing the resources in economics.

How to Calculate the Return on Assets with Example?

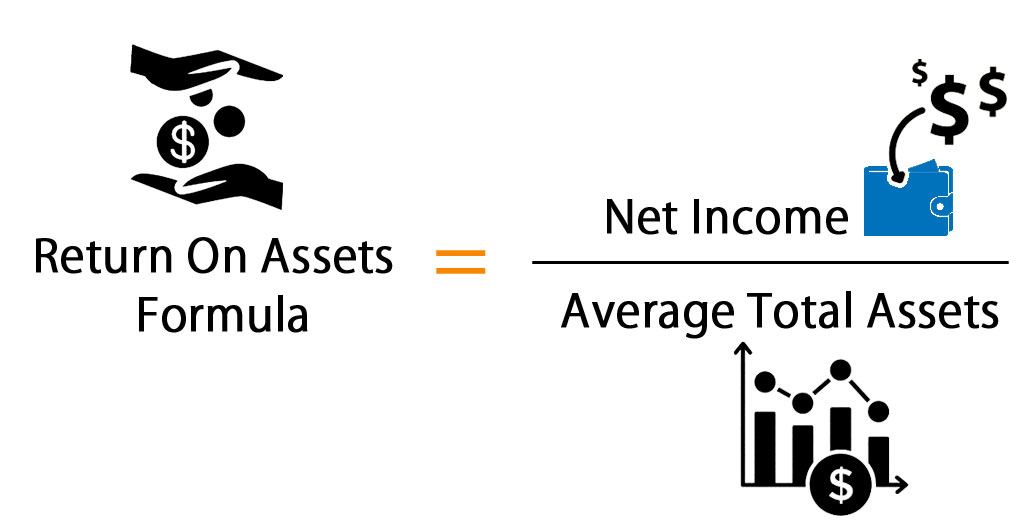

The Return on asset is a crucial metric as it shows the performance of the company’s operation and how effective it’s going in terms of profit earning. To calculate, here is the formula

Return on assets = Net income/ average assets

Or

Return on assets = Net income/ end of the period assets

Well, here, the net income is equal to the net earnings. Also, the average asset is equal to ending asset, however asset minus with the beginning asset and divided by 2.

For example: If the company is net income is $10 million with their current operation where they own the asset of $50 million according to their balance sheet. Then what will be there ROA?

Well to calculate the Return on the asset, $10 million will be divided by the $50 million which will be 0.2. Thus, it means ROA of the business is 20%. Also, to every dollar that the company debt and equity, there will be a return of 20 cents on its net profit, including all the deduction.

Why is Return on Asset Important?

The use of Return on asset is crucial for any company as it shows as well as analysis the profitability. The use of this ratio is mostly happening when there is a comparison of the performance of the company between the years or periods. Also, it is used to compare companies, too, which are similar and belong to the same industry. It also plays an important part in considering the scale of the business and its operations when it comes to using this ratio.

However, different companies have a different return on asset. Those industries who are capital intensive require higher numbers of fixed assets for their operation. Well the general ROA is lower as the larger asset base will boost the denominator so, if the company is high enough then it’s natural to have higher ROA too.

Also return on asset makes it easier to understand the companies. Apart from that, it helps in performing the financial analysis and help the analyst to get more detail information about the company. For the investors and creditors, the ratio is helpful to get the performance analysis of the company. For any business, higher ROA is beneficial, falling numbers in ROA can be issued. But for the creditors, it’s important to keep in mind that ROA doesn’t account when it comes to outstanding liabilities.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply