The scheme which is launched by the government in order to provide the way of saving money, also the subscribers get the PRAN when they opt for this system. Well, PRAN which also refer as Permanent Retirement account number which is allotted to every subscriber. Well, there are lots of things that the scheme bring for the people, however knowing better about it, here is the complete guide which will help. Not just that know about tax benefits and how they can help you in saving your money as well as deducting the tax amounts legally. There are different types that you can find in that process; here you can get the detail information which will make the process easier and simpler for everyone.

What is Tax Benefit Scheme.

Well, there are different names that are used for describing the term such as deductions, exclusions, and credits, however, all these are extremely helpful as well as beneficial that reduce the bill of your tax. For understanding it better, the tax benefit basically refers to opportunities that you get from tax law which let you reduce the bill of income tax only when are able to prove the eligibility requirements. Also, it comes with a lot of different forms. Apart from that, how much amount you can able to save is completely dependent on the tax benefits type you claimed as every type is little different and save different savings.

For knowing the subject much better, here are the types that can help you

1. Deductions saving tax: Counted as one of the common types that are used for deduction in tax. Well, when you claim for tax deduction the amount get reduced which are subjected for the tax. It’s precisely the amount of deduction that in your income which is legible for you to claim for the deduction. Well, mostly the deduction that is claimed is on the cost of the fees regarding tuitions, expenses related to medical, contribution for charity, and other incomes related to states.

2. Tax credits claiming: However this one has better potential as compare to any other options. Well, the reason is it gives you a deduction on your every pay instead of deducting it from the amount of income tax. The tax credits allow on the expenses that you do which involves the tuition or college fees, installation of equipment related to energy efficient etc. For claiming the tax, the first thing that you have to do is to read a separate form which should be credit specific and calculate the complete amount which is eligible instead of showing the claiming amount.

3. Capital losses for reducing tax: There is no doubt that capital loss is one of those experience that no one wants to have however it can be helpful for getting the tax deduction. This is also used for offsetting the capital gains that you had in the year. Well for getting the benefits, you have to submit the documents first.

NPS Tier I Account & Tax Benefits:

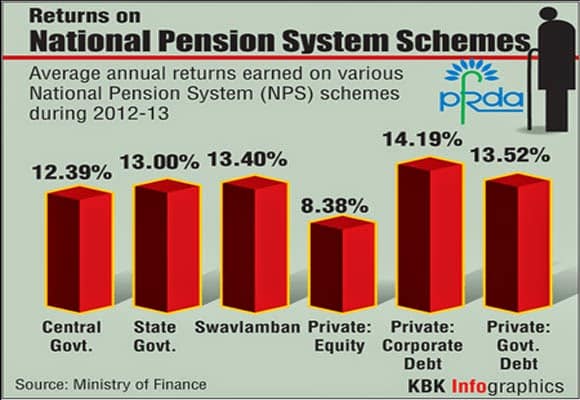

NPS which also stands for New Pension Scheme that is regulated by the PFRDA or Pension Fund regulatory and development authority. Well, NPS was introduced in the year 2014 for the government employees only but in 2009 the scheme becomes eligible for all citizens. It’s a product based on market-linked and also offers the returns which are on the performance fund.

Well NPS Tier I is aimed primarily for providing the benefits for post retirements to the investors. Also, the tier doesn’t allow any withdrawal and offer some various tax benefits for the people.

There are several points that you must know about Tier I which can avail benefits and for knowing better here are the points for help

- Its beneficial for salaried individuals as the investment is more than 10 percent including the salary and allowances is eligible for deducting from the income tax under section 80 CCD.

- For the employee that can be contributed director can be done via the employer with whom the employee is working. When it comes to investment routed via the employer then the contributed NPS more than 10 percent of the salary is eligible for deduction. However, there is no cap for this but the overall deduction claim should not go up to 10 percent.

- The subject is limited to Rs. 1.5 Lakh for those who are self-employed. For the annual gross income, the overall deductible amount is up to 20 percent

- Also, it allows the partial withdraw only for the purposes which are specific. However, it can be possible if the subscriber’s age is 60 or less than that.

- If the subscriber of NPS withdraw more than 60 percent of the corpus during his or her age of 60 then the remaining value will turn into an annuity which is basically a financial product that you get in the form of pension or periodic income

NPS Tier II Account & Tax Benefits:

NPS divided the work into two different tiers which I tier 1 and tier 2 for making the implementation easier as well as simpler. Tier 1 is considered as the basic account whereas tier 2 is flexible and has withdrawal rules that can be easily accessed. There are lots of benefits that the subscriber of tier 2 can get. Well, the NPS tier 2 came in action during its launch year which is December 2009. The tier is completely a saving product where the flexibility is also allowed.

The major benefits that you get in NPS tier 2 are its easy features that you can get. Well with the tier 2, you don’t get any restriction regarding how many times you can do the withdrawal. Even you can nominate facility as well as can do one-way transfer money from to different tier. Apart from that, it’s an ideal option for you if you are looking for something which is an investment in a medium-term tool. However, you are eligible to choose the fund options if you are not able to do that then the auto mode will do the investment on the basis of your profile as well as your age. For easy understanding, it can also be called as a liquid version of Tier 1 as here you get the flexibility in withdrawing the amount without any limitation. Also if you are doing the withdrawal before the prematurely of account, there will be no penalty fees charge against you. Also, you can do the contribution using your PRAN which is also known as Permanent retirement account number.

Difference Between NPS Tier 1 and tier 2.

Well, there are some basic differences that you can get in NPS tier 1 and tier 2. However, both are beneficial and they have theory own features that work fine. For knowing better here is the complete information about the differences

- Investment: the first account of NPS which is also known as Tier 1 is compulsory for the employees who are working with central government. Also for them, it’s mandatory to invest 10 percent of the salary including their DA and DP in the account every month which is matched with the contribution given by the government. However with tier 2 but it does not limit the people as other non-government employees can do the investments as well. But the amount that you require is around Rs 1000. Here you have to do at least four contributions in a year without any restrictions.

- Withdrawal: Tier 1 has strict rules against the withdraw however with tier 2 you are free to do with deals as long and as much you want without paying any penalty fees

- Fund transfer: Well you can do the transfer your fund from tier 2 to tier 1 anytime you like but when it comes to transferring the fund from tier 1 to tier 2 then it’s not possible

- Tax benefits: the subscriber of the tier 1 can enjoy lots of tax benefits and there are various offers for them, but with tier 2 there are not any benefits that allow for a tax deduction of the subscriber

What is Tax Deduction Offers by NPS?

There are different offers that you get in tax deduction by NPS. Here is what you need to know:

- Benefits for the individuals: Well the individuals can claim the deduction up to 10 percent on the gross income according to the under section 80 CCD (1) with 1.1 lac overall ceiling ( under sec 80 CCE)

- To the subscribers of NPS: This is an additional deduction which is avail for tier 1 investments more than Rs 50,000 for the subscribers of the NPS. The deduction falls under the subsection of 80 CCD (1B).

- Benefits for the cooperate sector: Well the benefit is divided into two categories such

- a) Corporates: the contribution by the employer for the NPS more than 10 % of their salary including the basic plus the DA is eligible for the deduction in form of business expenses. The deduction will happen in the profit & loss account.

- b) Corporate subscriber: Under the income tax act, the benefit is an addition and available for the subscribers who came in the corporate sector. The contribution by the employer toward the NPS include the 10 % of basic and Da salary, its deductible as taxable income without charging any limits regarding monetary.

What are the Issues Raised with NPS Scheme

There are benefits but again there are some drawbacks in NPS as well. However, these drawbacks also causing some people to stay away as these issues are going serious

1. the money is locked until the age of 60

Before you turn 60 that is the only bit of portion that you can access but until then the complete amount of yours is locked. Apart from that you also don’t have the access to the amount either which cause the serious issues for the investors.

2. Difficulties in premature

NPS is straightly a no option for those people who are going to retire before the time. Investing here can be an issue as you have to buy the 80% of the annuity. Not just that, the rate of annuity is lower for the young age. But again if you are not planning to do the exit even after you retire then you can continue it until you reach the age of 70.

3. Partial withdrawal restrictions

There is a limitation that you can get in withdrawal as you can only do withdraw more than 25% of the contribution from your own money. Also, you are only allowed to take the contributed your money by you, not just the employer contribution.

NPS Scheme for NRI’s

There is no doubt that NPS is a cost-effective as well as tax efficient scheme that helps the subscribers to save the money after the retirement. Also, they can cases their account freely and much easily as compare to any other option. But again the benefits completely depend on the contribution that you make and other factors. For those who are not from India or consider as NRIs, they can also open their account and also enjoy the benefits for sure. They can do their investment based on the classes of the equity and corporate bonds. The NRIs can do their investment on the basis of the assets if not they can also go for auto choice which do the investments on the behalf of them.

Conclusion:

NPS or National Pension Scheme is one of the tax beneficial things that help lots of people, however, they have its own drawbacks and the positive point which work differently in situations. Not just that the NPS is divided into two categories which is Tire 1, strict and especially for the central government employer and tier 2 which is open for everyone and also much flexible. There is no doubt that it can help in saving money and improving the afterlife of retirement. But again it’s important to understand better.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply