STATE BANK OF INDIA (SBI), well-known as “Banker to Every Indian”, headquartered in Mumbai, Maharashtra is the oldest multinational, banking and financial service provider in India. It offers a wide range of financial products through a wide network of branches. SBI also provides online banking services through onlinesbi.com, a user-friendly platform, for its huge customers. SBI has been receiving millions of transactions from its customers for its amazing digital banking services of Funds Transfer, Utility Bill Payment, DTH TV Recharge, Mobile Top Up, State & Central Government Tax Payments, e-Fixed Deposits, and many more.

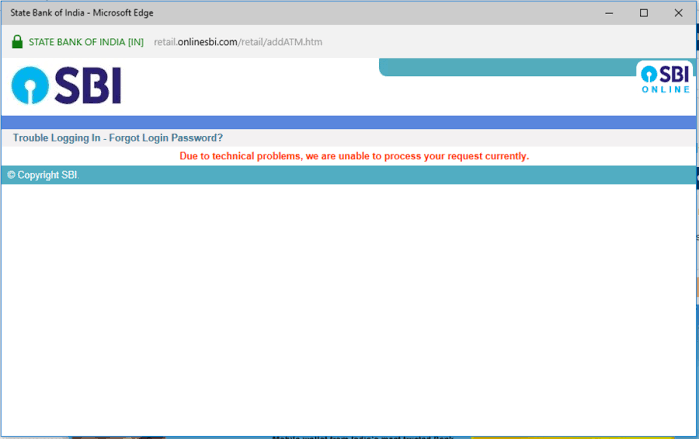

All you know that SBI online services added more convenience in your daily life. Is it right? Then, what to do if suddenly these services were down for a while when you are doing essential transactions? No worries! You landed on the right page! Here is a solution to access the digital banking service of your account right now by choosing some alternative methods. Let me share in detail in this post how to manage banking services if SBI Online server is down.

Why OnlineSBI Down Sometimes?

There may be so many reasons such as

- They may be upgrading their online website to give the best performance or UI to its customers.

- Sometimes bad internet connectivity may disrupt services.

In both cases, customers cannot able to do transactions smoothly. Look below for the best alternative options to access OnlineSBI.

Best Ways to Access OnlineSBI

- SBI Mobile Banking

It is SBI’s internet banking service provided for mobile users. In case the OnlineSBI portal is down, browsers can connect to their https://m.onlinesbi.com and manage most of the finances on the move with services like IMPS Transfer, Credit Card Bills, e-Flexi deposits, NPS Contributions, e-RD, Bill payments to already registered billers, e-TDR/e-STDR, Funds transfer to their own accounts and view balance amount & mini-statement.

- Phone Banking

This alternative functional service makes customers execute most of the banking transactions through contact officers over the phone. To avail the Phone Banking facility, users have to register their mobile number in the account through Contact Centre, ATM, or Branch. Upon post-registration, customers can avail of regular banking services like account related information, transfer funds, open fixed deposit, and more.

- SMS Banking

If you simply want to check balance or account statement, then you can use SMS Banking services, a free service from SBI Bank. Avail this facility by just giving a missed call or send an SMS from registered mobiles to their toll-free number. Within a few seconds, get details of account balance, mini-statement, education/home loan certificate statement, generate ATM PIN on your phone.

- Customer Care

Simplify your banking tasks with the general usage of the Customer care service of SBI. Just dial customer care and the phone will be diverted to the phone banking officer to solve your banking issues.

Conclusion

Considering many people worrying about bank websites down while doing transactions, here we shared the helpful post with various alternatives to make a hassle-free banking facility with SBI.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply