FreshBooks is a worthy consideration whether you are a medium to large-sized company or a limited company looking to ease your accounting needs within the comfortable constraints of an inexpensive bundle.

What is Freshbooks?

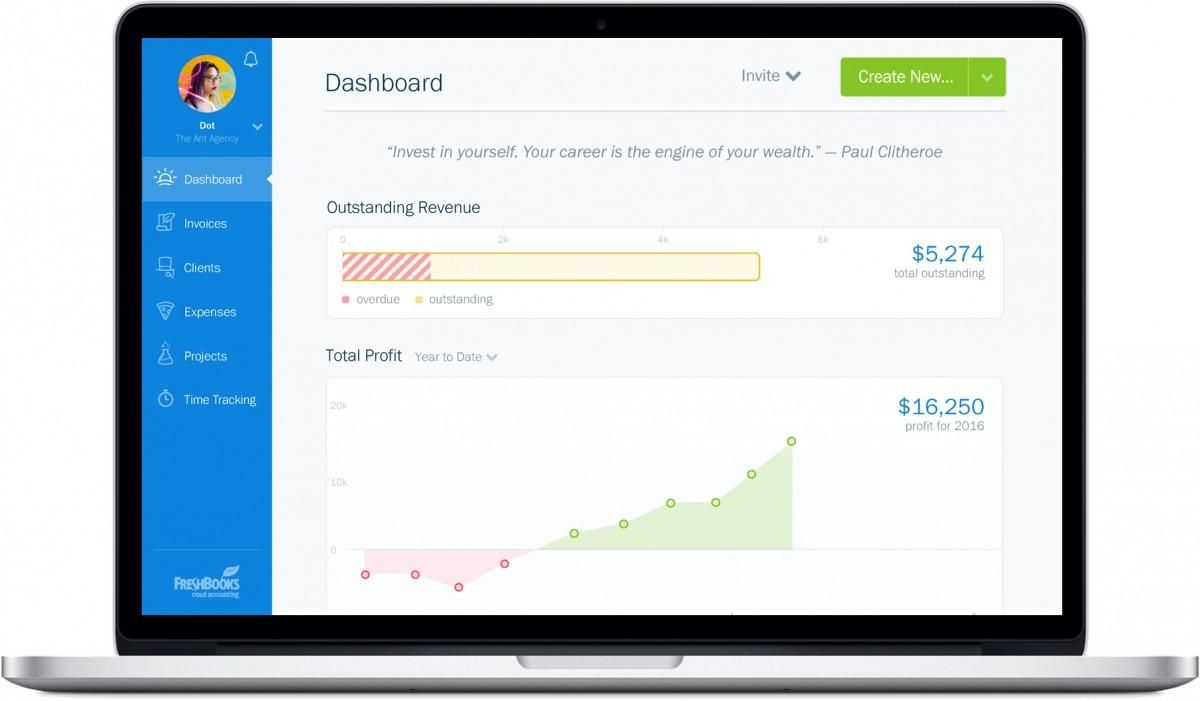

FreshBooks is a complete, cloud-based accounting company that will offer an easy-to-use kit that can tick most boxes for a fairly low outlay. Within its browser-based design, you’ll find an entire offer a wide range covering every and every aspect of operating a company. If you are a single freelancer or someone who develops a company and hires employees, it doesn’t count.

FreshBooks is a bit tricky to use, has the potential to grow for your company needs, and when you build up your accounting profile, luckily keeps those stress levels down.

Read More – Planning to Take a Quick Loan? Know What your Options are!

Who should use Freshbooks?

Freshbooks gives an easy way to track revenue and expenses for the self-employed people. Currently, this management accounting provides a Self-Employed edition and a Teams system that can be used if you have regular workers or staff working for you, but the system remains a great match for the sole owner or freelancer.

When you just start or do not intend to recruit an employee, then FreshBooks is for you. However, if you find your company expanding, more appropriate items are available.

How FreshBooks helps you to create an invoice?

FreshBooks lets you easily produce, deliver, and handle invoices. The invoice screen shows you precisely how your documents will appear when you submit them so that you don’t need to press a preview button to make sure they look perfect. To add new clients, goods or services, reviews, terms and notes, you just click on the button – you don’t have to build them on a separate button before adding them to an invoice. If you want lines to be rearranged on an invoice, simply drag and drop them in place. With FreshBooks creating invoices is simple.

Freshbooks helps in the invoice in the following ways:

- Add your logo or a photo and change the template, font, and accent colour to customize invoices and other documents to suit your branding.

- Instead of creating new invoices from scratch, convert estimates and proposals to invoices in two clicks Also, the software allows you to duplicate a previous invoice and tweak the details, which may be faster than creating a new one.

- In just a couple of clicks add a discount, deposit request, or payment schedule.

- Schedule the program for automatically submitting regular invoices and payment reminders; you can also set it as a percentage or flat fee for adding late fees to past due invoices.

- You will see when customers display your invoices after your invoices are sent, so you don’t have to worry whether the invoice was received or was lost in a spam folder.

- When you’re away from the office, use the mobile app to send invoices.

- FreshBooks supports multiple languages and currencies, which is helpful if you have clients from around the world.

Must Read – How To Go About Refinancing Your Student Loan?

Pros of Freshbooks:

- Invoicing-It’s easy to create invoices. Which helps me get the invoices out more quickly. It keeps items automatically, so I can re-use them later. For example, if I want to charge a customer for a digital transfer fee, I can select that item from the drop-down menu and even fill the rate I used in the past.

- Templates- The design helps me to stay coherent and knowledgeable in my branding. You can add your logo and select a theme color to match your brand. You can choose between two different template layouts.

- Automatic importing of expenses-I use two separate credit cards for my company. One card for non-billable items and another card for items charge my customers for.

Cons of Freshbooks:

- Templates- One of my greatest grips about Freshbooks is that if you change the Terms section on an invoice, it will change it all over the board for will potential invoice. I often have to change my terms, depending on customer and job. This makes it very difficult to keep anything organized.

- Price- If you don’t use all of the Freshbook apps, it’s a little pricey for what you’re getting unless you have only a few customers.

- Importing expenses-If I import expenses automatically, Freshbooks often miscategorized products and when I use my Chase accounts, sometimes it does not fill in the vendor portion.

Conclusion:

FreshBooks wasn’t a feasible accounting option for small companies in the past, and the fact that it was positioning itself as “FreshBooks Cloud Accounting” was frustrating. Now, by offering double-entry accounting and main accounting features, such as bank reconciliation and reporting, FreshBooks finally lives up to its reputation.

While with its latest updates FreshBooks has made promising strides, the software is costly and lacks important features, such as accounts receivable. QuickBooks Online and Xero both have marginally more costly plans than FreshBooks but provide significantly better reporting, more functionality, and more users — and even free services like Wave have plenty to sell for $0/month.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply