EPF (Employee provident fund). It is where the employees of any big organisation contribute 12% of their salary on the provident funds and later, these funds will be given to them after the retirement. However, sometimes we need these funds earlier, and we do know about the situations and the urgency for the withdrawal of EPF. You can withdraw your EPF completely or partially that is depend upon your current need. In this post, we will tell all the details you need to know for filling the EPF withdrawal form online and when can you withdraw funds from your PF account.

However, you must link your aadhar card with PF account for the online withdrawal process.

When can EPF be withdrawn?

You can either withdraw your all provident funds entirely or partially, and that is depend upon your need. However, it also depends upon specific circumstances.

- A) If the individual retired from employment.

- B) If the individual remains unemployed for more than two months. However, the same has to certified by the gazetted officer.

Further, you can make a complete withdrawal of provident funds without remaining unemployed and by switching from one job to another.

If you want to make a partial withdrawal from your PF then it can be done but under the following conditions:

- Marriage: You can partially withdraw up to 50% of the funds from your PF account. In case, if any marriage is in your family but the service criteria under this category is minimum of seven years for the partial withdrawal.

- Education: Service criteria under this category is a minimum of seven years for partial withdrawal. So, you can withdraw up to 50% from your PF.

- Purchase of land/purchase or construction of a house: You can withdraw up to 24x of your salary in case if you are purchasing land and 36x of your salary if you are buying the home. The service criteria under this circumstance is a minimum of five years. The property should be under your name, wife or joint.

- Home loan repayment: You can withdraw up to 90% from the employers and employee provident fund for the home loan repayment. The service criteria required under this circumstance is a minimum of ten years.

- Renovation of the house: You can withdraw up to 12 times of your salary for the renovation of the house. The service criteria of a minimum of five years are needed under this circumstance, and the property should be the name of the owner.

- A Little before retirement: You can withdraw up to 90% before your retirement and once, you reach the specific age of 57 or more.

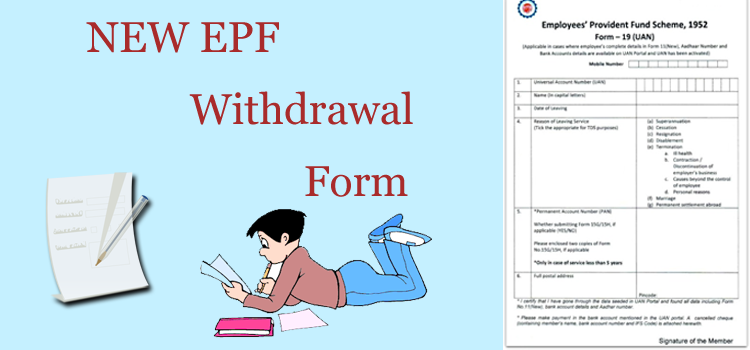

How to Fill EPF withdrawal form online?

We do know that you can withdraw your provident funds anytime but sometimes, it is difficult to visit the office, queue in line and then fill the form to get our funds to withdraw. Therefore, the secure method to withdraw your funds online is using the UAN portal. Let me show you how can you withdraw your EPF online.

You need to make sure that you do have access to UAN login and password and along with this, you must have an active internet connection.

- First, you need to visit the UAN login page, and you can do this by clicking here: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Second, you need to login to the UAN portal by using correct credentials.

- Once logged in, from the menu bar choose ‘Online Services’ tab and select ‘Claim (Form-31, 19 & 10C)’ from the drop-down menu.

- Your details will get display on the screen.

- Enter the last four digits of your account number linked to your EPF account and click on verify.

- Click on “Yes” to sign the certificate of the undertaking and proceed further

- Now click on the online claim.

- Now, you need to select the “PF Advance (Form 31)” for the online claim.

- A new form will appear on the screen, and first, you need to specify the reason for getting advance funds withdrawn.

It is worth noting that all options for which the employee is not eligible for withdrawal will be mentioned in red.

- Tick on the message and click submit.

- Now, you need to submit all the original scanned documents for the purpose you need your funds withdrawn.

- Once the submission of the documents is complete, you will receive a message from EPFO and post the verification of documents you will get your funds in your bank account. This can take up to 15-20 working days.

Benefits of EPF Withdrawal Online:

You can receive several benefits for withdrawal provident funds online, and some of the benefits are mentioned below.

- Hassle-free Withdrawal: Now, you have an option to withdraw your funds online instead of standing in line on the PF office. This is the first benefit of online withdraw of provident funds.

- Reduced processing time: If you go through the office, then it would take more time to transfer your funds, and from the online withdrawal process, you will get your funds in less time.

- No need to visit the previous employer for verification: Unlike last option that first you need to visit the PF office for the documents and application submission and then you need to get your documents verified from the officer. But in this case, you need to go for any verification from the officer. Your documents will automatically be verified from the online system.

Conclusion:

We do understand the need for urgent withdrawal of provident funds. Previously, you need to visit the PF office and get your application verified from the officer, and this process takes more than a month but, due to the availability of UAN portal, you can not only withdraw your provident funds online but also transfer your PF from old account to your new PF account.

You can either withdraw your EPF partially or entirely, and that will depend upon your situation. In this post, we do have mentioned all the details you need to know about the withdrawal process and how can you withdraw EPF online.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply