Savings are a big part of your financial planning, but this big part generally gets absorbed by expenses. To make your savings work for you, you have to utilise them. A salaried individual’s financial planning may differ from others because of his/ her diverse requirements. They have the day to day expenses and other life goals to take into account. And when it comes to retirement planning, the accumulated amount from EPFs (employee provident funds) or other such retirement schemes is usually insufficient to meet post-retirement requirements and objectives.

When it comes to a salaried individual it becomes important to know in regards to the investment options so that when they are investing the journey is smoother thereafter. There are many options in the market, for instance, you can go with a LIC saving plansor invest in the mutual funds and so forth that suits your requirement and is affordable for a salaried person.

Best Investment Options for Salaried individual

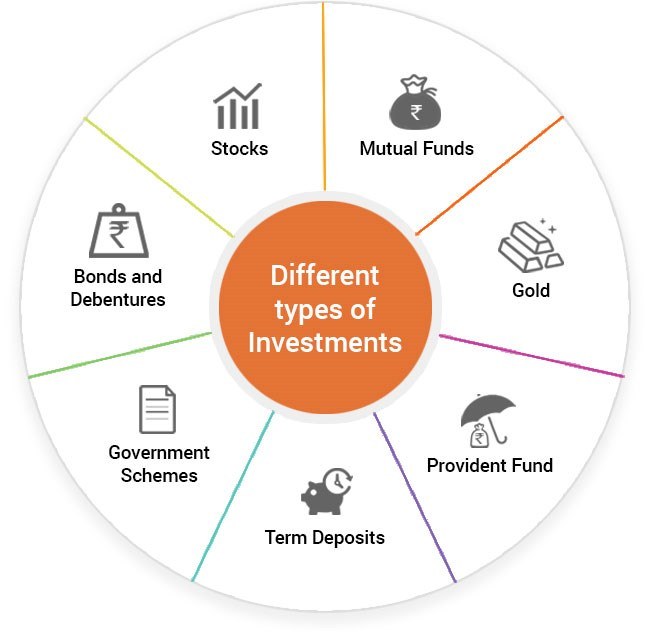

As you are aware that there are many options available for any regular salary earner to invest in, but some of them may not be suitable for everyone. They may vary on many bases, like risk appetite or period. So, here are the best investment opportunities for a salaried individual:

- Public Provident Fund (PPF)

Public provident fund is much better because it is the safest investment among the other options because of the sovereign guarantee from the government. This option has gained popularity because of itslock-in 15 years and better annual interest. Public provident fund is offering interest of 7.9 % annually (as of August 2019). For a salaried person, it is one of the best investment options because under Section 80C public provident fund investment qualifies for a tax deduction. At the time of maturity, the returns or withdrawn amount is tax-free. And also it has a minimum investment limit of Rs 500 and maximum investment limit of Rs 1.5 lakh in a financial year.

- Fixed Deposit (FD)

Fixed deposits are suitable for every kind of investor because they offer high yield with longer and shorter tenures. Fixed deposits are generally preferred by those who are interested in higher returns and are not afraid of risks. Fixed deposits can be bank fixed deposits, corporate fixed deposits and non-convertible debentures (NCDs). But the interest of this investment is added to the taxable salary. Under Section 80C, you can save taxes by investing in tax- saving FDs (fixed deposits). The tax-saving FD (fixed deposit) has a locked-in period of 5 years and is payable on a monthly or quarterly basis. It can also be reinvested. It is one of the safest options among the best investment options because of the fixed income and higher interest rate. In India, you have countless options when it comes to an opening a fixed deposit account in a bank such as State Bank of India, Axis Bank, HDFC Bank, ICICI Bank, and so forth.

- National Pension Scheme (NPS)

It is a government initiative that aims to provide solutions to pension-related problems. The invested amount of national pension scheme goes into different products like Bonds, securities, equities and other alternatives as per the interest of the investor. It gives two choices to the investor: Auto and Active. In ‘Auto’ the investment is allocated to different products according to the system while in the ‘Active’ option, the investor gets to decide the assets to invest.NPS has locked- in the period till you reach the age of 60 or you can extend the maturity time to 70 years as well. At the time of withdrawal, about 40 % of the accumulated amount (corpus) is to be necessarily invested in an annuity plan. The remaining 60 % is divided, 40 % out of 60 % is tax-free,and 20 % is taxable as regular income.

- Equity Mutual Funds (MFs)

Equity mutual funds invest 65 % or more of their amount in stocks (equities). These funds are better than any other fixed-income instruments because they outperform any other product in the long run. They are more suitable for retail investors, investors who neither have the experience nor time to invest. One special category that equity mutual fund has is Equity Linked Saving Schemes (ELSS). Under Section 80C of the Income Tax Act, it also qualifies for a tax deduction. It also has the shortest lock-inthree years, which is the shortest among all the other options under Section 80C. Some of the ideal performing equity funds are Axis Bluechip Fund, SBI Focused Equity Fund, DSP Midcap Fund, and much more.The starting investment in equity mutual fund is just Rs. 5000 for lump sum and Rs. 1000 can also be added as an additional investment.

- Unit Linked Insurance Plan (ULIP)

Unit linked insurance plan (ULIP) is sort of a combination of life insurance and market-based investment. In ULIP, a part of the premium goes into the insurance of the investor, and the other part goes into other fund options such as bonds, stocks, market instruments, etc. they offer death benefits as well as maturity benefits like other long term investments. It has a lock-in period of 5 years, and it comes under Section 80C and qualifies for a tax deduction. Investor enjoys one major benefit in ULIP that is various fund options. The investor can switch to any fund option given for any reason, be it risk factor or market change. Insurance companies such as Aegon Life, Canara HSBC, Max Life, and so forth offer a Unit Linked Insurance Plan. This is surely one of thebest investment optionsfor anyone afraid of fluctuating market or risk involvement.

- Debt Mutual Fund

Debt funds are a type of mutual funds. These funds invest in fixed return instruments such as treasury bills, certificate of deposits (COD), corporate bonds, debt securities, government securities and other money market instruments. Debt mutual funds’ investors can grow their wealth with minimal risk. The invested instruments create a fixed rate of interest throughout the term period, which the investor stays invested in the fund. Some of the popular performing debt funds are IDBI Liquid Fund, Kotak Corporate Bond Fund, DSP Overnight Fund, etc. These funds generate higher income than fixed deposits and are stable, unlike equities. Also, these funds do not charge a penalty on premature withdrawal except a few debt funds. This makes debt funds one of the best investment options among the short tenure investment instruments.

Wrapping it Up

The given instruments are some of the best investment options for salaried individuals. These options are best for a salaried person because of his/ her diverse requirements and limitations. Whether investing in any of the LIC saving plans, selecting a ULIP, or choosing the government-backed schemes, etc. No matter what, investing in these instruments will be best if done with utmost consideration and analysis on factors such as time horizon, the risk involved, base market, interest rate, liquidity, total accumulated income, and tax payment.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply