Are you burdened with various types of debts? Then you can apply for a loan to combine them into one single debt and repay it.

The process of consolidating debt into a personal loan involves is about repaying individual loans. Some lenders payout loans on the borrower’s behalf, while others payout proceeds to the borrower to make payments to themselves.

But how do you go about getting a debt consolidation loan? Who qualifies, and is it even worth it?

Here’s everything you need to know about debt consolidation loans and paying off debt.

Debt Consolidation vs Delver aging Programs

The difference between debt consolidation loans and deleveraging programs is significant. Multiple debts can be collected into one larger debt. This is a great strategy for better financial health.

These kinds of loans have favorable repayment terms, low interest rates, and low monthly payments.

Suppose you have $30,000 of unsecured debt (think credit cards, car loans, medical bills, etc.).

A debt consolidation loan from a private credit company combines your various debts, such as your credit card bills and mortgage payments, into one.

Debt consolidation is a combination of several of these debts into a monthly bill. Perks include lower interest payments, greater debt relief, and better financial security.

Avoid High Interest Rates

Taking out a high interest rate loan is expensive and can leave you even more in debt. You should always try to consolidate your high interest debts into a more manageable payment.

If you have $30,000 in unpaid debt (think credit cards, auto loans, and medical bills), that could include a $10,000 two-year loan at 12% interest and a $20,000 four-year loan at 10% interest. Your monthly payment for the first loan is $517, and the payment for the second is $583.

A 4 percent interest rate on a student loan repaid at a temporary 0 percent interest rate on a credit card may sound reasonable, but remember that double-digit interest rates can follow if you don’t repay the debt during the promotional period.

You also need to be aware of the initial fees that can increase your overall cost of financing and reduce your loan proceeds. If you’re not careful, you can overdraw a low-interest credit card on which you’ve paid high interest and end up enjoying a better deal with a single payment.

Minimum Payments Are Not Enough

The allure of a simple payment and the promise of a low-interest rate may be enough to make you dream of the day when you can stop worrying about money.

But minimum payments don’t seem to do enough to keep debt collectors in check. To avoid this, always check your budget to make sure you can cover new payments.

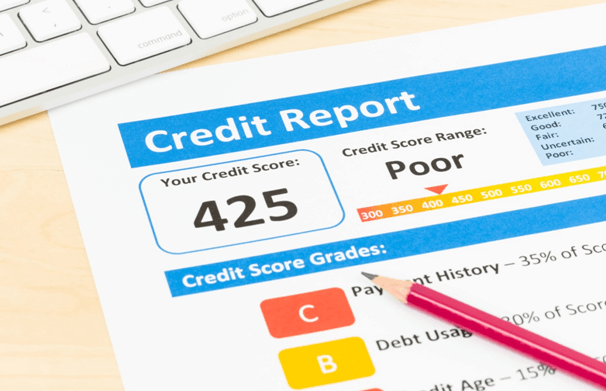

If your credit rating is not high enough to apply for a loan with a low-interest rate. It makes no sense to consolidate debt. Even if you could pay off all your debts today, it’s only a matter of time before they spiral out of control. Debt consolidation is feasible if your creditworthiness has improved sufficiently to apply for several high-interest loans.

If you want to think about debt consolidation, you should not do so without addressing the underlying problems that lead to your current debt and excessive spending.

Don’t Rob Peter To Pay Off Paul

Repaying several credit cards with a loan is not an excuse to accumulate credit and can lead to significant long-term financial problems. You can consolidate debt with a transfer offer if you qualify for an unsecured consolidation loan if you have excellent credit.

If you have large equity contained in your house, you can get a better interest rate on a mortgage or an unsecured consolidating loan.

Debt management programs are private and confidential options for people with debt, and consumer proposals to consolidate or reduce your debt through a legal process or some form of bankruptcy can be used before other options are considered.

Debt consolidation options target consumers who are in financial difficulties or who don’t have great equity.

Credit Counselling and Advice

There are a few ways you can combine your debts and combine them into a single payment. Credit counseling and debt adjustment programs help you in paying off debt.

They are called consolidation programs because they consolidate your monthly payments to make only one payment per month. A lender and a monthly bill can help you repay your debt faster, avoid missed payments and lower your credit rating.

If you are considering a debt consolidation loan, talk to your credit card issuer to find what would be needed to repay the debt at the current interest rate and compare possible new loans.

The debt consolidation process will reduce calls, letters, and debt collection agencies and provide new loans that are kept up to date.

Credit Worthiness

Lenders look at your creditworthiness, income, and debt-to-income ratio to determine how able you are to repay your loan.

This means you need to have a high credit rating and a low leverage ratio to qualify for new loans. You need a FICO credit score of at least 650, but some lenders consolidate bad loans, and they only accept credit scores of 600 or less.

Debt Consolidation Is Key

It is quite common for those unable to manage their credit cards, car loans, and household expenses to take out the first available loan product.

In other words, the repayment of loans takes precedence over the purchase of new niceties or growing new debts.

But debt consolidation is key when you are in a financial mess. This means you are in control of your debts and clearly see how much you owe.

For more, be sure to check out the rest of our site.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply