Nifty 500 is a popular and diverse index that stands out in the Indian market by including the 500 biggest and most liquid companies together. These companies represent almost every sector of the country.

Understanding the Nifty 500 is a key factor for retail investors to make an investment portfolio that offers consistent returns.

Tips For A Diverse Investment Portfolio using Nifty 500

Follow these tips to build a diverse investment portfolio using the Nifty 500 index.

Analyze Your Existing Portfolio

Start building your diverse investment portfolio by studying what you already own. When you know what the assets in your portfolio are, it helps to avoid any overconcentration in a certain sector or asset class.

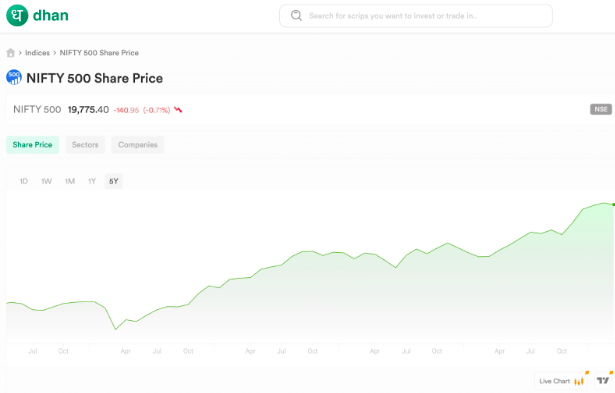

An insightful data analysis will set the stage for informed decision-making and ensure a fair distribution of resources. Also, you should check the Nifty 500 share price, their recent performance, and growth potential before investing in these stocks.

Understand Your Risk Tolerance Level

Every investor has a different talent for tolerating risk, affected by factors like financial goals, investment horizon, or personal circumstances. However, that does not mean that you need to avoid exploring certain sectors that have a potential for future investment.

By understanding your risk appetite you can fine-tune your investment strategies and mitigate risks strategically.

Diversification

Diversification across sectors is important in any investment strategy that is designed to minimize risks. Utilizing the Nifty 500, you can diversify your investments across different markets.

For example, you can diversify your portfolio by adding a few stocks from finance, construction, FMCG, healthcare, etc. Make sure to have a good mix with a lower correlation with each other.

Regularly Review and Rebalance Portfolio

The stock market is always in a state of turbulence and fluidity. Therefore, it is important to make regular adjustments to your portfolios. Develop a rebalancing strategy that sets up your portfolio in a way that embraces changes in the market, as well as your investment goals.

Top Companies in Nifty 500

Here are the top Nifty 500 companies in 2024:

| Company Stock | Market Cap as

of March ‘24 |

Share Price as

of March ‘24 |

| Reliance Industries | Rs. 19,78,790 Crores | Rs. 2957 |

| Tata Consultancy Services | Rs. 14,80,580 Crores | Rs. 4110 |

| HDFC Bank | Rs. 10,65,500 Crores | Rs. 1416 |

| Infosys | Rs. 6,95,236 Crores | Rs. 1665 |

| ICICI Bank | Rs. 7,39,424 Crores | Rs. 1073 |

| Hindustan Unilever | Rs. 5,66,498 Crores | Rs. 2428 |

| State Bank of India | Rs. 6,68,721 Crores | Rs. 755 |

The above listed companies are the top players in the Indian stock market. As a result, they have a substantial impact on the Nifty 500’s general performance.

The Bottom Line

Diversifying your investment portfolio using the Nifty 500 can help you mitigate the risk of fluctuations in the stock market in the long run. These tips can help build an investment portfolio and fulfill your financial objectives.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply