Many businesses have reliance on logistics for the success of their organisation. This involves movement of goods which include raw materials into for production purposes and delivering the finished product at the place of demand. With extreme long distances that are required to be covered by these transport vehicles, having a backup plan that offers protection is essential and what better than a commercial vehicle insurance?

Just like your personal car requires mandatory insurance cover, commercial vehicles also need to have vehicle insurance. The Motor Vehicles Act of 1988 makes it mandatory for all vehicles registered in the country to have vehicle insurance which includes commercial vehicles too.

Why is it essential to have commercial vehicle insurance?

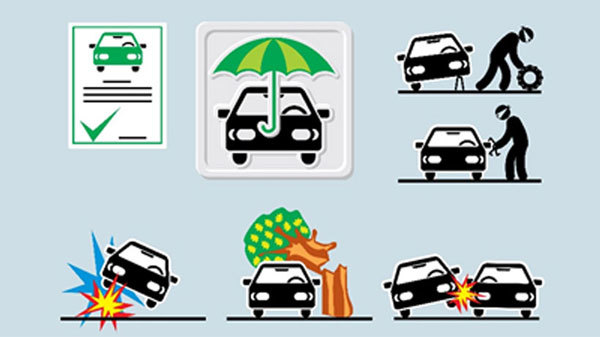

Insurance for commercial vehicles is important since logistics function is critical to any business. An accident or damage not only has loss of materials or goods being transported but also financial loss in the repairs and replacement. While insurance can be sought for goods, a commercial vehicle insurance helps to ensure a safety net for the vehicle too.

During an accident, it is medical expenses that might be required on one hand whereas the repair costs of the vehicle are also essential. In aggregate these expenses can have a hefty blow to your bank account. To avoid these unexpected expenditures, a commercial insurance coverage is essential.

What are some considerations to remember when buying a commercial policy?

Now that you know why a commercial vehicle insurance is important for your business, here’s what you need to keep in mind when buying one –

Selecting adequate coverage: A commercial policy is best useful when it has an adequate sum insured that can cover the repair costs. In some situations, just finalising between third-party and comprehensive coverage is not enough. You need to take a step further to determine the coverage offered by your insurer is adequate and its underlying scope of events. Not just one but various situations should be considered like driving conditions, the terrain and driving styles when selecting commercial vehicle insurance.

Managing premium and policy benefits: As commercial vehicles are used only for business purposes, it is of key importance to manage the cost associated too. Thus, getting a policy with the right add-ons while keeping in check the premium is essential. Moreover, the type of vehicle also determines the premium amount, i.e. premium for a mini van differ from a truck trailer or a tractor. When picking out a policy, it is essential you use a motor insurance calculator so as to get budget-friendly plans with the right insurance coverage.

Make use of tech: Making use of technology can aid in claim submission. Dash cameras, anti-theft devices, are some examples that can help to submit the necessary claims to your insurance company.

These are some ways what you should look for in a commercial insurance policy. Also, do not purchase a policy with the lowest premium as it may not always be beneficial for you and your business in the long run. Make sure to compare the features in different plans and then determine what fits your business transportation needs. Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure/policy wording carefully before concluding a sale.

Smriti Jain is the owner and senior content publisher at Financesmarti. Financesmarti is a website where she shares a lot of useful stuff for the people and business of India. This includes small business ideas and other banking information, as well. Smriti completed her education in science & technology from Delhi University. Smriti usually has interests in digital marketing now, and she has chosen this career for the full-time opportunity. The primary purpose of starting this blog to provide quality information on the banking industry to the people.

Leave a Reply